Classification Demo

Classification makes up the largest portion of the U.S. Customs broker exam, usually around 12-15 questions will be dedicated to this category. This section will only require the HTS catalog when answering questions, but note that not all questions will ask to specifically classify an item, some questions require you to reference the General notes section, or chapter notes.

Luckily the classification portion is made easier simply because the exam is multiple questions, and there is almost never a “none of the above” choice. This can still be one of the most difficult sections of the test, it is suggested you continuously review the classification lesson and topics as well as take the Classification quiz.

In the course, the classification lesson covers how to quickly maneuver the HTS Catalog, understand the General Rules of Interpretation, as well as provides multiple example questions and how we break down the correct answers.

Classification Example

In order to follow this question, either have your HTS catalog out or review the HTS chapters at: https://hts.usitc.gov/current

Question: What is the classification for 48 hair combs, worn in the hair, made of silver (a precious metal), valued at $22 per dozen pieces?

Answer:

A) 9615.19.2000

B) 7113.11.2080

C) 9615.11.1000

D) 7113.11.5080

E) 9615.19.4000

The most important information in the question is that the material is silver, a precious metal. Precious metals are found only in Chapter 71. Chapter 96 is for miscellaneous manufactured items, and if you read note #4 of Chapter 96, it reads:

Articles of this chapter, other than those of headings 9601 to 9606 or 9615, remain classified in the chapter whether or not composed wholly or partly of precious metal or metal clad with precious metal, of natural or cultured pearls, or precious or semiprecious stones (natural, synthetic or reconstructed). However, headings 9601 to 9606 and 9615 include articles in which natural or cultured pearls, precious or semiprecious stones (natural, synthetic or reconstructed), precious metal or metal clad with precious metal constitute only minor constituents.

From this note, we know that the silver hair comb cannot be classified under headings 9601 – 9606 or 9615. Because of this note, answers A, C and E are automatically invalid because silver constitutes the whole item, not minor.

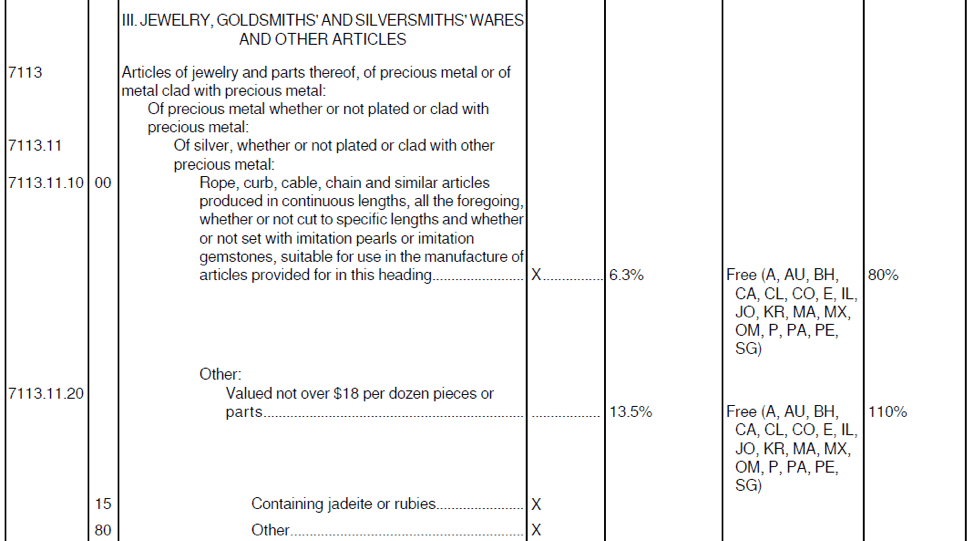

Answer B) 7113.11.2080 gives us:

The subheading 7113.11.20 states that the item is not valued over $18 per dozen, the question states the combs are sold at $22 per dozen. So answer B is incorrect.

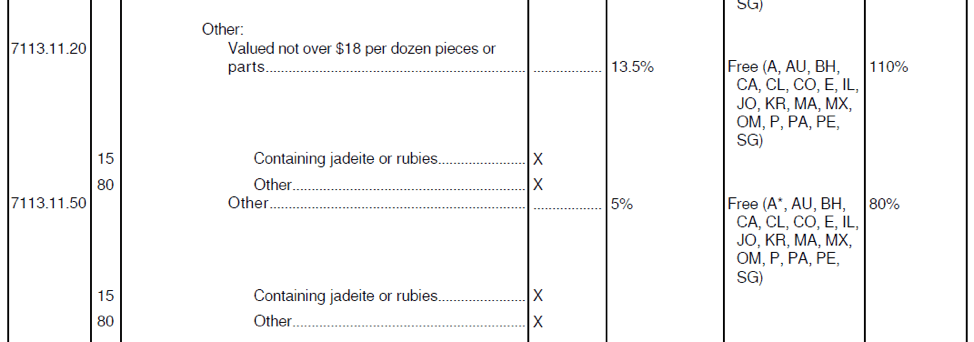

Answer D) 7113.11.5080 gives us:

Subheading 7113.11.50 does not specify the value like 7113.11.20, so it implies that the values are over $18 per dozen. Answer D is the only correct answer.